The EORI number refers to the Economic Operator Registration and Identification number, which is a part of a system that is applied at the level of the European Union (EU). The EORI number is necessary for entities that trade goods across the EU member states and it is designed for customs operations. If you will trade goods in Greece, then you will need an EORI number in Greece; please be aware that the obligation to have an EORI number is not only imposed to commercial companies, it can also be required in the case of certain categories of individuals introducing goods on the Greek market. In this article, our team of Greek lawyers will present some of the most important matters concerning the EORI number.

| Quick Facts | |

|---|---|

| EORI number – definition | The EORI number stands for Economic Operator Registration and Identification Number, which is applied in all EU member states to all entities that are considered economic operators. |

|

When is EORI required |

The EORI is necessary when an entity (legal entity or individual) is considered to be an economic operator that trades goods across the EU borders (in other words, it is involved in import-export operations). |

|

Entities that must have an EORI number |

– companies; – individuals involved in trading activities. |

| Institution in charge with the issuance of the EORI | Independent Authority for Public Revenue – General Directorate of Customs & Excise (Customs Authority). |

| Application details required for legal entities |

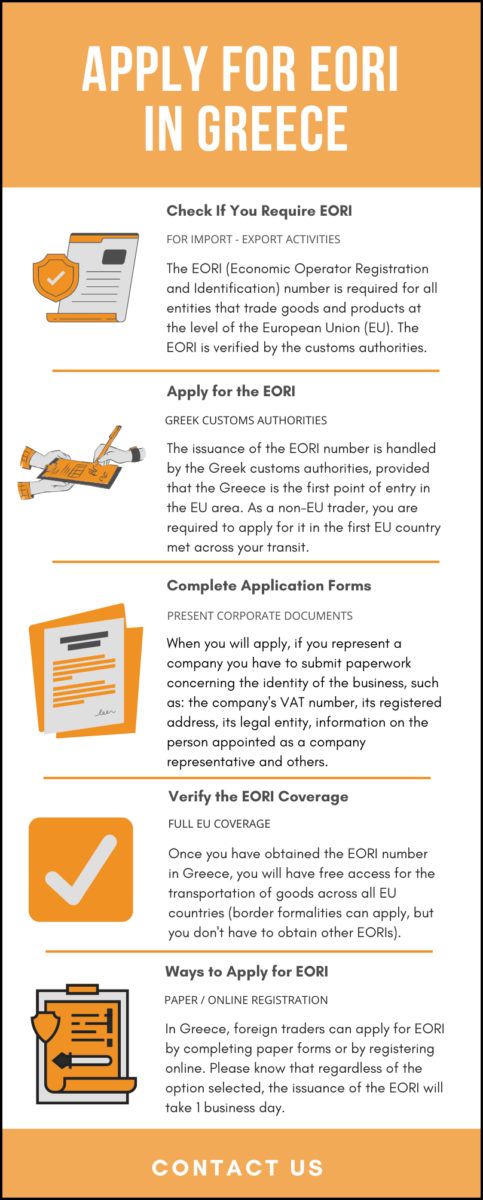

For EORI registration in Greece, businesses will have to provide information on the following: – the address of the company; – its legal form; – the name and details of the person representing the company; – contact details of the company’s representative; – the company’s VAT number. |

| EORI coverage |

EORI is available at a EU level, therefore entities that will obtain the number in Greece will be able to use it in any other EU countries. |

| Customs formalities for non-EU individuals |

Individuals introducing goods in Greece with a value above EUR 1,000 are required to complete the Single Administrative Document (SAD), valid at a EU level. |

| Structure of the EORI number |

The EORI number is comprised of 2 main elements: – the country code of the EU member state that issues the EORI; – a number that is unique at a EU level. |

| Registration formalities for non-EU businesses |

A non-EU company must complete the steps for EORI registration in Greece when this country is the first point of entry in the EU area. When transiting other EU states, the Greek EORI will still be available. |

| When it is necessary for non-EU companies to register | Non-EU companies must register if they are economic operators that must comply with customs procedures, as per the rules of Article 5 of Reg. 2446/2015. |

| EORI law at a EU level |

The Union Customs Code (UCC) |

| Costs for the issuance of an EORI number |

EORI registration in Greece is free of charge. |

| Ways to apply for an EORI |

– electronically; – on paper. |

| Main elements of the Greek application form |

The Greek EORI application form contains the following elements: – the name and surname of the applicant; – company’s address; – information on whether the entity is registered in the EU area or not; – the legal status of the entity; – the Commercial Registry details; – the main place of business; – contact information; – the VAT details; – economic activity code; – the date of establishment of the business; – consent to disclose the above mentioned. |

| Duration of the issuance of the EORI | 1 business day |

Table of Contents

How can one obtain the EORI in Greece in 2024?

As an entity dealing with the import-export of goods, if you are interested in importing goods on the Greek market, you will need an EORI in Greece. The procedure will be handled by the Greek Customs Authority. The number is necessary for all entities which are issued with a VAT number and it will be issued based on application form provided by the said institution.

All interested entities will have to provide information on all the elements of the application (the form is written in Greek and English, so, as a general rule, it should be easily completed, but in the case in which applicants have difficulty in dealing with this document, our team of lawyers in Greece can help). In the list below, you can find out information that is required when preparing the application for EORI registration in Greece:

- the name of the person filling the form, the residential address of the person or of the company;

- the date of birth of the applicant or the incorporation date of the company;

- the legal status of the applicant – natural person, legal entity, association of companies, etc.;

- information of the contact person – name, address, e-mail, phone number;

- the VAT number and the code associated with the business operations of the applicant.

This type of form can be found in all European countries, and the procedure to register will be the same. However, it is necessary to know that each country can impose specific rules, within the limits of the European EORI framework, which means that certain procedures that may apply in a country will not be imposed by the customs of other EU states.

Please know that 2024 brings an important change for those who need to register for EORI. The change is also addressed to those who are already registered for EORI. Thus, starting with 1 February 2024, all registered entities and those who request to register must provide a postal code, that will be linked to their EORI.

Economic operators who are already registered must address the national authority where they have registered initially (Greece, in this case), or the online platform of the European Commission to see if their data is accurate. If they didn’t provide a postal code in the initial registration form, they must add it, so that their future customs procedures will not be negatively impacted by this new formality.

Below, you can watch a short presentation on the EORI number in Greece:

This is also the case of Greece, which has certain particularities, along with other few EU member states. Regarding the EORI in Greece, there are certain differences with regards to the mandatory registration of simple consumers, who are individuals purchasing goods from elsewhere or who import various goods. Our Greek law firm can offer more details regarding the following:

- from all the 27 EU member states, 4 require consumers to apply for an EORI number – this is the case of Bulgaria, Czech Republic, Greece and Lithuania;

- the EORI number in Greece in this case is necessary provided that the value of the shipment is above EUR 1,000;

- if the shipment is below EUR 1,000, the consumer will not need the EORI in Greece, but has to provide a tax ID for custom clearance;

- the EORI system has been introduced in 2009 and it is applied to both EU businesses and businesses outside the EU, but the obligation to have an EORI number will vary based on the activities developed by the economic operator;

- please mind that the United Kingdom (UK), which used to be a part of the EU, still applies the EORI system, even though the UK finished its exit formalities at the end of 2020.

What are the formalities for applying for EORI in Greece in 2024?

The formalities for an EORI number in Greece are similar for both Greek tax residents as well as for non-EU economic operators. Greek tax residents must apply for an EORI number in Greece, while other EU economic operators will apply for it with the customs authorities of the countries where they are tax residents.

In Greece, after the application form is completed, the applicant must present along with the form specific supporting documents. All these will then be analyzed by the representatives of the Greek Customs and if the data is correct, the entity will be assigned with an EORI number in Greece.

For non-EU entities, the same procedure will apply; please mind that the EORI number is issued only for entities that fall under the definition of an economic operator. You can find out more details regarding this mater from our Greek law firm. If you need legal assistance for the EORI registration in Greece, our team of Greek lawyers can always help you and can inform you about other customs obligations that can apply to your business.

If you need assistance in other legal matters, such as if you are interested in the procedure applicable to foreigners who want to buy land in Greece, you can also refer to our Greek lawyers.

Our team can present the formalities you have to comply with based on your nationality (while EU citizens benefit from simple rules, available for Greek nationals, third party nationals must complete immigration requirements).

If you are interested in knowing if you need an EORI number in Greece in 2024, you must know that the Independent Authority for Public Revenue of Greece stipulates that you have to verify the main requirements with the Customs Authorities of Greece.

This is necessary if you are an economic operator established in Greece (all Greek economic operators have to obtain their EORI number in 2024 from the Greek Customs). It can also be required to apply for an EORI number in Greece in 2024 as a third party business.

In this case, you have to do so if Greece is the first point of entry in the EU. The obligation to apply for an EORI in 2024 for non-EU entities is done if the entity performs customs operations as per the Article 5 of the Reg 2446/2015.